Category

Mutual Fund

**How to invest in mutual funds without any prior knowledge about it?**

Investing in mutual funds can be a smart way to grow your wealth, even if you have no prior knowledge of the financial markets. Here's a step-by-step guide on how to start your mutual fund investment journey without any prior expertise.

**1. Educate Yourself:** The first and most crucial step is to educate yourself about mutual funds. A mutual fund is a pool of money collected from many investors which is managed by a professional fund manager. The manager invests the pooled money in a diversified portfolio of stocks, bonds, or other securities.

There are various types of mutual funds, such as equity funds, debt funds, hybrid funds etc. each with its own risk and return profile. Take some time to read articles, watch videos, and gain a basic understanding of these concepts.

**2. Set Clear Financial Goals:** Determine your investment goals. Are you investing for retirement, a major purchase, or simply to grow your wealth? Knowing your objectives will help you choose the right type of mutual fund and develop a strategy.

**3. Seek Professional Guidance:** If you're unsure about where to start, it's highly recommended to seek professional guidance. An expert can assess your financial situation, risk tolerance, and investment goals, and suggest suitable mutual funds thus reducing costly financial mistakes.

**4. Select a Mutual Fund:** Always makes sure that you choose a mutual fund that aligns with your investment goals and risk tolerance.

**5. Open an Investment Account:** To invest in mutual funds, you'll need to open an investment account. The account setup process is typically straightforward and involves providing some personal and financial information. The platform you choose will guide you through the necessary steps.

**6. Start with a Small Investment:** It's a good idea to start with a small amount of money, especially if you're new to investing. Many mutual funds have a minimum investment requirement, which can vary from scheme to scheme and AMC to AMC too. Make sure to check this requirement and ensure that it fits your budget. Starting small helps you understand how investing works without risking a lot of money.

**7. Monitor your investments:** After investing in a mutual fund, it's crucial to review your portfolio. You can track your investments through the online platform where you opened your account. Check the performance of your funds periodically and compare it to your investment goals. Be prepared to make adjustments to your portfolio if your goals change or if a fund consistently underperforms.

**8. Continuous Learning:** Investing is an ongoing process. As you gain more experience, continue to educate yourself about mutual funds and investment strategies. Read books, attend seminars, and stay updated with financial news. The more you learn, the better equipped you'll be to make informed investment decisions.

Investing in mutual funds without knowledge is possible, but it's important to know that all investments have risks. Mutual funds too can fluctuate in value, and it's possible to lose money.

If you ever feel uncomfortable making investment decisions on your own, don't hesitate to seek professional guidance. Education, planning, and expert advice can lead to a successful mutual fund investment journey.

Read More →

Category

Mutual Fund

In a kingdom where golden towers touched the sky and opulence graced every corner, there lived a wise and benevolent king named Raja Vikram. Despite the abundance surrounding him, the king was ever-curious about the true nature of wealth.

One day, as Raja Vikram strolled through the bustling marketplace, he encountered a poor poet named Kavi Arjun. The poet, though impoverished, possessed a wealth of wisdom and an uncanny ability to spin tales that touched the soul.

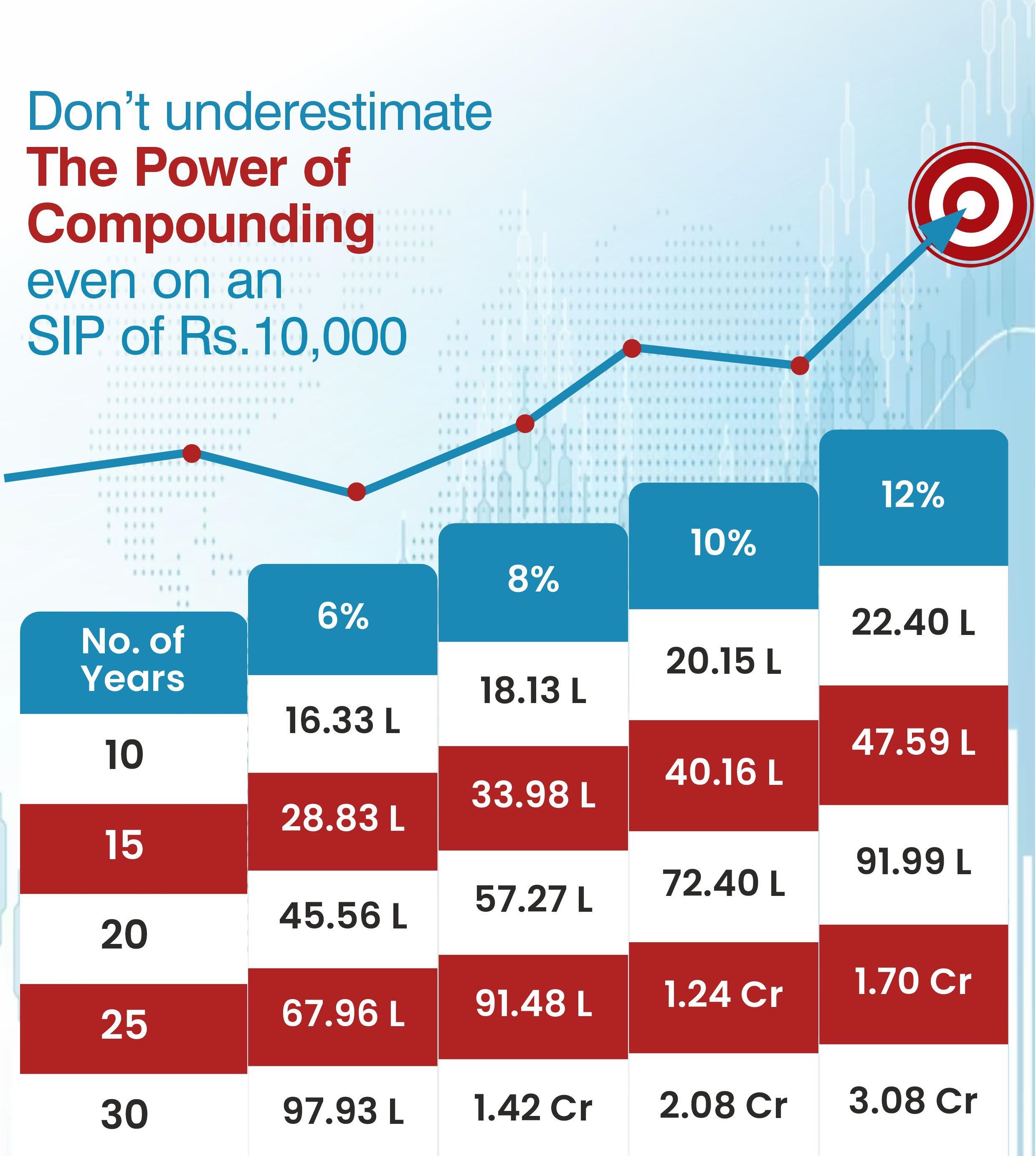

Intrigued by Kavi Arjun's presence, the king invited him to the palace, eager to glean insights from the humble poet. Little did they know that their encounter would unveil the profound lesson of compounding, a lesson that would echo through the corridors of time.

In the grandeur of the palace, Kavi Arjun, with his poetic grace, began to share a tale—a tale that involved a chessboard, grains of rice, and the magic of compounding.

"Your Majesty," the poet began, "imagine a chessboard, a simple board with 64 squares. Now, picture placing one grain of rice on the first square, two on the second, four on the third, and so forth, doubling the amount with each square."

As the poet narrated, the king, his courtiers, and even the palace staff listened with rapt attention. The seemingly simple task of placing grains of rice on a chessboard took an astonishing turn.

"On the first half of the chessboard," continued Kavi Arjun, "the piles of rice grow gradually. But it is in the second half, Your Majesty, where the magic unfolds. The power of compounding turns those seemingly insignificant grains into an astronomical abundance."

The king, captivated by the unfolding story, envisioned the compounding effect at work. He marveled at how the rice, like investments, could grow exponentially over time.

As the tale concluded, Raja Vikram pondered the profound implications of compounding. Inspired, he turned to Kavi Arjun and said, "Your wisdom has unlocked a treasure trove of understanding. The compounding grains of rice have taught me that true wealth lies not just in the amount we start with but in the consistent growth over time."

Embracing the lesson, Raja Vikram initiated a kingdom-wide campaign to educate his subjects on the power of compounding. The palace gardens echoed with discussions on savings, investments, and the importance of starting early.

The impact of compounding rippled through the kingdom, transforming the financial landscape. Citizens began to recognize that small, consistent efforts in savings and investments could lead to substantial wealth accumulation over the years.

As the years passed, the kingdom prospered not just in material riches but in the financial literacy of its people. The once-humble poet and the wise king had set in motion a legacy—one where the power of compounding grains of rice became a metaphor for the enduring growth of wealth through time.

In the end, it was not just a tale of rice and chessboards; it was a story that illuminated the transformative potential of compounding, a lesson that, like the echoes of a poetic verse, reverberated through generations, leaving behind a legacy of financial wisdom and prosperity.

Read More →